In today’s rapidly advancing world of technology and innovation, 3D printing—or additive manufacturing—has evolved from a niche prototyping tool into a powerful force shaping industries as diverse as healthcare, aerospace, automotive, construction, and consumer products. Investors searching for future-ready, high-growth opportunities are increasingly turning their attention to 5starsstocks.com 3D printing stocks. This is where platforms like 5starsstocks.com become highly relevant, offering structured analysis, ratings, and insights tailored for both beginner and experienced investors.

In this comprehensive article, we will explore the potential of 3D printing as an investment avenue, how platforms like 5starsstocks.com can help assess these stocks, what to look for when evaluating companies in this space, and the broader implications for market performance, innovation, and global economic transformation.

Understanding 3D Printing: A Technological Overview

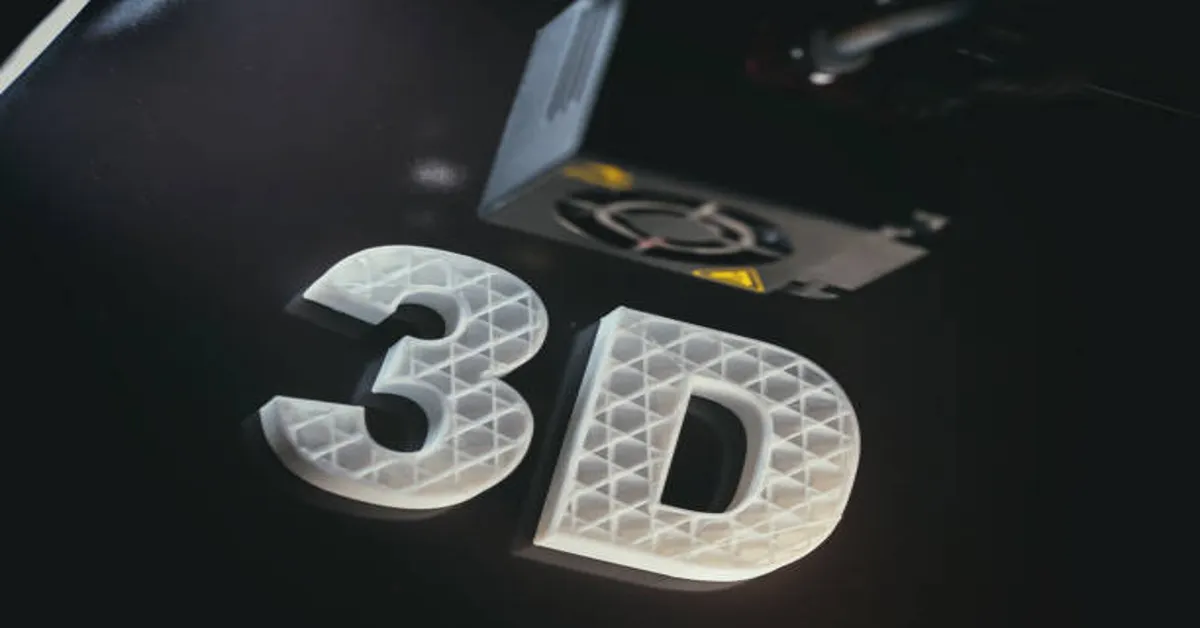

3D printing, also known as additive manufacturing, is the process of creating a three-dimensional object layer by layer from a digital design. Unlike traditional subtractive manufacturing methods, which involve cutting away material from a solid block, additive manufacturing builds an object from the ground up, reducing waste and enabling intricate designs that would be impossible or cost-prohibitive using conventional techniques.

There are several primary types of 3D printing technologies, including:

- Fused Deposition Modeling (FDM): Uses thermoplastic filaments melted and deposited in layers.

- Stereolithography (SLA): Uses UV light to cure photopolymer resin layer by layer.

- Selective Laser Sintering (SLS): Uses a laser to fuse powdered material, typically plastic, metal, or ceramics.

- Direct Metal Laser Sintering (DMLS) and Electron Beam Melting (EBM): Used for printing high-strength metal components.

Each of these technologies is suited to specific use cases, such as prototyping, production of aerospace parts, custom dental implants, or even bioprinting human tissues.

The Economic Impact of 3D Printing

The global 3D printing market has seen exponential growth over the past decade and is projected to continue expanding robustly. This surge is driven by:

- Cost Efficiency: Reduced material waste and lower tooling costs.

- Design Flexibility: Freedom to create complex and customized products.

- Decentralized Manufacturing: Possibility of on-demand production near the point of use.

- Speed to Market: Rapid prototyping shortens product development cycles.

Industries that have embraced 3D printing include healthcare (e.g., prosthetics and implants), aerospace (lightweight parts), automotive (tooling and end-use parts), and consumer goods (custom eyewear and fashion accessories). As a result, the value of 5starsstocks.com 3D printing stocks is intrinsically tied to innovation trends across multiple sectors.

5starsstocks.com: An Analytical Approach to Stock Evaluation

5starsstocks.com is an investment-focused platform that categorizes and rates publicly traded companies using proprietary metrics and analysis frameworks. While the site covers a wide range of industries and stock types, one of its most intriguing sectors is the 3D printing segment.

The platform is especially beneficial for retail investors seeking reliable insights without deep technical backgrounds. It simplifies stock evaluation into categories like growth potential, innovation capability, financial health, market traction, and future outlook.

By combining quantitative data with industry trends, 5starsstocks.com allows investors to form a grounded, research-based perspective on which 3D printing companies may be well-positioned for future success.

Core Features of 5starsstocks.com for 3D Printing Investors

When it comes to evaluating 5starsstocks.com 3D printing stocks, 5starsstocks.com utilizes several critical dimensions to assign ratings and present profiles:

1. Innovation Score

This reflects a company’s investment in R&D, the uniqueness of its technology, patents filed, and partnerships with institutions or governments. Innovation is crucial in the 3D printing space, as differentiation often comes from proprietary material science, machine design, or software.

2. Financial Stability

The platform analyzes liquidity, profitability, and debt structure. Many 3D printing companies are still in growth stages and may not be consistently profitable. Understanding their burn rate, cash reserves, and break-even outlook is essential.

3. Market Penetration

This covers customer base, industry partnerships, geographical expansion, and market share. A company supplying to Boeing, BMW, or NASA, for example, gains a more favorable outlook.

4. Sustainability and Scalability

A vital factor in long-term growth is whether the company’s business model is scalable. Does it rely on one-time machine sales or recurring revenue from materials and software licenses? Does it serve high-margin industries?

5. Valuation vs. Growth Potential

Even in a high-growth industry like 3D printing, overvaluation can be a red flag. 5starsstocks.com compares price-to-sales, P/E ratios, and other metrics to industry norms and projected growth rates.

Examples of 3D Printing Stocks Often Profiled on 5starsstocks.com

Although the exact list may evolve, some common companies tracked in the 3D printing sector include:

1. Stratasys Ltd. (SSYS)

A pioneer in FDM and PolyJet technologies, Stratasys serves various industries including healthcare, education, and manufacturing. Its emphasis on open material systems and enterprise-level machines makes it a key player in B2B solutions.

2. 3D Systems Corporation (DDD)

One of the oldest and most diversified 3D printing companies, 3D Systems has offerings that span prototyping, production, and healthcare. With deep experience and a large patent portfolio, it remains a strong candidate for long-term growth.

3. Desktop Metal (DM)

Focusing on metal printing, Desktop Metal is a relatively new entrant but has quickly gained attention for its production-ready systems that aim to replace traditional manufacturing. It also offers subscription-based services, making it attractive for recurring revenue.

4. Materialise NV (MTLS)

Based in Belgium, Materialise provides software and medical 3D printing services. Their cloud-based solutions make them unique in a hardware-dominated space, and they have strong recurring revenue from software licenses.

5. Nano Dimension (NNDM)

Specialized in additive manufacturing of electronics and printed circuit boards (PCBs), Nano Dimension is one of the few companies merging AI and 3D printing for intelligent production systems.

Risks and Considerations in 3D Printing Investment

While the growth potential of 3D printing is significant, investors must remain mindful of the risks:

- Technological Displacement: New methods or materials may render existing technologies obsolete.

- Regulatory Hurdles: Especially in healthcare and aerospace, certifications can delay market entry.

- High R&D Costs: Innovation requires continuous investment, often impacting short-term profitability.

- Market Volatility: Many 3D printing companies are small to mid-cap, making them susceptible to market swings.

Platforms like 5starsstocks.com help contextualize these risks by offering up-to-date data and comprehensive overviews.

How to Use 5starsstocks.com for Portfolio Building

To build a well-diversified 5starsstocks.com 3D printing stocks investment strategy using 5starsstocks.com, follow these steps:

- Identify Investment Goals: Are you looking for high-growth, high-risk opportunities or stable long-term performers?

- Filter by Sector: Use the platform’s categorization to view companies in the additive manufacturing sector.

- Compare Ratings: Look at innovation, financial health, and scalability scores to identify potential outperformers.

- Read Company Profiles: Each profile includes insights into leadership, product lines, key milestones, and market positioning.

- Track Market Trends: 5starsstocks.com often provides trend analysis, news updates, and future projections to support investment timing.

3D Printing Stocks vs. Traditional Manufacturing Stocks

Unlike traditional manufacturing companies, 5starsstocks.com 3D printing stocks firms often operate on asset-light models, relying more on intellectual property than large physical infrastructure. This results in:

- Faster adaptability

- Higher margins (over time)

- Greater environmental sustainability

- Closer alignment with Industry 4.0 trends

However, traditional manufacturers have brand legacy, existing supply chains, and mass production experience. Investors must decide whether they want to bet on disruptors or diversify across both domains.

The Role of ESG in 3D Printing Investments

Environmental, Social, and Governance (ESG) factors are increasingly important for modern investors. 3D printing is inherently more sustainable than traditional methods, reducing material waste and enabling localized production. This makes many 5starsstocks.com 3D printing stocks attractive from an ESG perspective, a factor 5starsstocks.com often highlights in their sustainability ratings.

Outlook: The Future of 3D Printing Stocks

The trajectory of 5starsstocks.com 3D printing stocks depends on:

- Continued technological improvements in speed, materials, and precision

- Broader adoption across industries beyond prototyping

- Government and institutional support for digital manufacturing

- Education and training to address the skills gap in design and engineering

As these trends align, companies that have robust IP, a scalable business model, and global reach will likely become dominant players in the space.

Final Thoughts

5starsstocks.com 3D printing stocks is more than just a technological trend; it’s a paradigm shift in how goods are designed, produced, and delivered. Investing in this sector offers the opportunity to be part of a transformation that rivals the internet revolution or the rise of renewable energy. With tools like 5starsstocks.com, investors have the advantage of structured data, clear insights, and actionable evaluations to guide their decisions.

Whether you’re a tech-savvy investor or simply looking to diversify into future-forward industries, understanding how to evaluate 5starsstocks.com 3D printing stocks—and leveraging platforms that simplify this process—is a powerful strategy for long-term success.

ALSO READ: Comprehensive Exploration of Adovivo.com

FAQs

1. What is 5starsstocks.com and how does it help with 3D printing stocks?

5starsstocks.com is an investment research platform that evaluates publicly traded companies, including 3D printing stocks, using proprietary rating systems based on innovation, financial health, scalability, and market performance.

2. Are 3D printing stocks a good long-term investment?

Yes, 3D printing stocks have long-term growth potential due to their applications in emerging industries, sustainability, and the digital transformation of manufacturing.

3. How does 3D printing differ from traditional manufacturing?

3D printing builds objects layer by layer from digital designs, allowing for reduced waste, faster prototyping, and customized production, unlike traditional methods that often subtract material.

4. What are the risks of investing in 3D printing stocks?

Risks include high R&D costs, volatile market performance, regulatory barriers in certain sectors, and rapid technological evolution that may outpace existing products.

5. Can I use 5starsstocks.com without advanced financial knowledge?

Yes, the platform is designed to be user-friendly and interprets complex financial and technical data into accessible scores and summaries for retail investors.